- BHT

- 0

9

9

0

0

The United States government now carries an unprecedented $36 trillion in national debt, a figure so astronomical it defies comprehension for most citizens. What sounds even more shocking? A growing chorus of crypto analysts and financial strategists are seriously calculating whether Bitcoin could serve as an unconventional solution to this mounting crisis. This isn't mere speculation from fringe enthusiasts anymore. Mainstream economists are running the numbers, and the result is staggering: Bitcoin would need to reach approximately $1.85 million per coin for the US government to theoretically use its Bitcoin reserves to address the entire national debt. This crypto news revelation has ignited fierce debates across trading floors, congressional hearings, and social media platforms about the future role of digital assets in sovereign finance.

Join Binance today to stay ahead of market-moving developments and position yourself for the cryptocurrency revolution transforming global economics.

Understanding The Magnitude Of America's $36 Trillion Debt Mountain

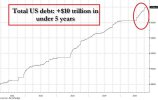

The United States national debt has reached an incomprehensible $36 trillion, growing by thousands of dollars every second. To put this in perspective, if you stacked $36 trillion worth of one-dollar bills, the pile would extend well beyond the moon and back to Earth multiple times. This debt represents decades of deficit spending, wars, economic stimulus packages, and the compounding interest that accompanies such massive borrowing.

Current projections show this debt continuing to climb, with interest payments alone consuming an increasingly larger portion of the federal budget. Traditional economists warn of inevitable consequences: Higher taxes, reduced government services, or potentially catastrophic inflation if the Federal Reserve continues printing money to service these obligations. This dire backdrop explains why some forward-thinking analysts have begun exploring radical alternatives, including leveraging cryptocurrency market dynamics to address fiscal challenges.

The blockchain technology underlying Bitcoin offers something traditional fiat currency cannot: Absolute scarcity. With only 21 million Bitcoin ever to exist and approximately 19.5 million already mined, this digital asset presents a fixed supply in an era of unlimited monetary expansion. This fundamental difference has prompted serious discussions about Bitcoin's potential role in national reserve strategies.

Current Bitcoin Price Analysis And The Road To $1.85 Million

As of late October 2025, Bitcoin trades around $111, 000 per coin, representing impressive gains from previous years but still astronomically far from the $1.85 million target required in our theoretical debt-elimination scenario. To reach that price point, Bitcoin would need to appreciate approximately 2, 700 percent or roughly 27 times its current valuation.

While this sounds impossible, Bitcoin's historical performance shows such massive gains aren't unprecedented in the cryptocurrency market. Bitcoin surged from under $1, 000 in early 2017 to nearly $20, 000 by December of that year. It later crashed, recovered, and eventually exceeded $69, 000 in November 2021. These explosive moves demonstrate that cryptocurrency investing involves volatility and potential returns unlike any traditional asset class.

Open your Binance account now to access professional trading tools, advanced security features, and the world's most liquid cryptocurrency exchange.

Several factors could theoretically drive Bitcoin to such elevated valuations. Institutional adoption continues accelerating, with major corporations, hedge funds, and even some sovereign wealth funds allocating portions of their portfolios to digital assets. The approval of Bitcoin ETFs has opened floodgates for traditional investors who previously couldn't or wouldn't directly purchase cryptocurrency. Each wave of adoption reduces available supply while increasing demand pressure on price.

The Mechanics Behind The $1.85 Million Calculation

The mathematics behind this scenario are straightforward yet mind-bending. With approximately 19.5 million Bitcoin currently in circulation and $36 trillion in debt to eliminate, dividing $36 trillion by 19.5 million yields roughly $1.846 million per Bitcoin. This assumes the US government would somehow acquire the entire Bitcoin supply, an impossibility given that millions of coins are permanently lost, held by ideological maximalists who would never sell, or locked in wallets whose owners have died without sharing access credentials.

A more realistic scenario might involve the government acquiring a smaller percentage of total supply at lower prices, then hoping for appreciation to create value sufficient to offset debt. However, this strategy faces its own paradox: If the US government began aggressively purchasing Bitcoin, the price would skyrocket from demand pressure, requiring exponentially more capital to continue accumulation. Conversely, if the government tried selling massive Bitcoin holdings to pay debt, the resulting supply shock would crash prices, destroying the very value they hoped to realize.

This economic puzzle highlights why cryptocurrency trading requires sophisticated understanding of market dynamics, supply and demand mechanics, and behavioral economics. Professional traders on platforms like Binance navigate these complexities daily, using advanced tools to analyze trends and execute strategic positions.

Cryptocurrency Market Dynamics And Institutional Adoption Trends

The cryptocurrency market has matured dramatically over recent years, evolving from a niche interest of tech enthusiasts to a legitimate asset class commanding trillions in total market capitalization. Bitcoin dominance fluctuates but generally hovers between 40-50 percent of the entire crypto market, with Ethereum and various altcoins comprising the remainder.

Institutional adoption represents perhaps the most significant trend reshaping digital asset markets. Major financial institutions like BlackRock, Fidelity, and JPMorgan have launched cryptocurrency services for their clients. Corporate treasuries, led by companies like MicroStrategy and Tesla, have allocated significant resources to Bitcoin holdings. Even El Salvador adopted Bitcoin as legal tender, conducting a real-world experiment in cryptocurrency-based national finance.

This institutional wave brings several consequences. Increased legitimacy attracts regulatory clarity, as governments recognize they must create frameworks rather than attempt futile bans. Greater capital inflows provide stability and liquidity, reducing the extreme volatility that characterized Bitcoin's early years. Professional market makers and sophisticated trading infrastructure make cryptocurrency exchange platforms more efficient and accessible.

Start trading on Binance with industry-leading security protocols, competitive fees, and access to hundreds of digital assets for portfolio diversification.

Bitcoin Investment Strategies For New And Experienced Traders

Whether you're exploring cryptocurrency investing for the first time or you're an experienced trader, understanding proper strategy is essential. The crypto market operates 24/7, never sleeping, with prices influenced by factors ranging from regulatory announcements to Twitter posts from influential figures.

For beginners, the dollar-cost averaging approach offers a sensible entry strategy. Rather than attempting to time the perfect entry point, investors purchase fixed dollar amounts at regular intervals regardless of price. This method smooths out volatility and removes emotional decision-making from the equation. Over long timeframes, DCA has proven effective for Bitcoin accumulation.

More experienced traders might employ technical analysis, studying chart patterns, support and resistance levels, and various indicators to identify optimal entry and exit points. Others focus on fundamental analysis, evaluating Bitcoin's network metrics like hash rate, transaction volumes, and wallet growth to assess underlying health and adoption trends.

Risk management remains paramount regardless of strategy. Professional traders never invest more than they can afford to lose entirely. They use position sizing to limit exposure to any single asset. Stop-loss orders protect against catastrophic drawdowns. Diversification across multiple quality projects reduces concentration risk while maintaining upside exposure.

The Role Of Major Exchanges In The Cryptocurrency Ecosystem

Trading platforms like Binance serve as critical infrastructure for the entire cryptocurrency market. These exchanges provide the liquidity, security, and technical capabilities that enable millions of users to buy, sell, and trade digital assets efficiently. Binance specifically processes billions in daily trading volume, offering access to spot markets, derivatives, staking services, and numerous other crypto financial products.

Security represents the paramount concern for any cryptocurrency exchange. Binance employs bank-grade security measures including cold storage for the majority of user funds, multi-signature wallet technology, and comprehensive insurance policies. Two-factor authentication, anti-phishing codes, and withdrawal whitelist features provide additional layers of protection for user accounts.

Beyond simple buying and selling, modern exchanges offer sophisticated services that allow users to maximize returns on their cryptocurrency holdings. Staking programs let users earn passive income by supporting proof-of-stake networks. Lending services generate yield by providing liquidity to margin traders. Savings products offer guaranteed returns on stablecoin deposits.

Experience the full suite of Binance services and discover how advanced cryptocurrency financial products can optimize your investment strategy.

Regulatory Landscape And Government Attitudes Toward Cryptocurrency

Government regulation of cryptocurrency remains one of the most important factors influencing market development and price action. The United States has taken a fragmented approach, with various agencies claiming jurisdiction and often providing conflicting guidance. The SEC focuses on securities regulation, the CFTC oversees derivatives markets, FinCEN enforces anti-money laundering rules, and the IRS demands tax compliance.

This regulatory uncertainty has hindered some institutional adoption while creating opportunities for jurisdictions offering clearer frameworks. Countries like Switzerland, Singapore, and the UAE have established comprehensive crypto regulations that attract blockchain businesses and cryptocurrency investment funds. This regulatory arbitrage puts pressure on the US to clarify its stance or risk losing technological leadership and economic opportunity.

Recent developments suggest growing acceptance of cryptocurrency by US policymakers. The approval of spot Bitcoin ETFs marked a watershed moment, representing implicit acknowledgment that Bitcoin deserves treatment as a legitimate financial instrument. Congressional hearings increasingly feature balanced discussions rather than blanket condemnation. Several states have passed crypto-friendly legislation to attract blockchain companies and innovation.

The question of whether Bitcoin could ever become part of official US reserve strategy depends heavily on continued regulatory evolution. For Bitcoin to play any role in addressing national debt, Congress would need to authorize such acquisitions and develop frameworks for managing cryptocurrency holdings. While this seems unlikely in the immediate future, the idea has transitioned from absurd to merely improbable, a significant shift in just a few years.

Comparing Bitcoin To Traditional Reserve Assets Like Gold

Gold has served as humanity's primary store of value for millennia, representing the standard against which Bitcoin is most frequently compared. Both assets share key characteristics: Scarcity, durability, divisibility, and portability. However, Bitcoin offers several theoretical advantages over physical gold.

Bitcoin's supply is absolutely fixed and verifiably scarce through its blockchain protocol. Gold's supply, while limited by geology, continues growing as mining companies extract new ounces. Bitcoin can be transmitted globally in minutes for minimal fees. Gold requires physical transport with substantial security costs. Bitcoin holdings can be verified instantly through blockchain transparency. Gold requires assaying and authentication procedures.

Conversely, gold benefits from thousands of years of established trust and cultural acceptance. Bitcoin has existed for less than two decades. Gold faces no technological risks like software bugs or quantum computing threats. Bitcoin's entire value depends on continued functionality of its network and community consensus. Gold generates no yield but also incurs storage costs. Bitcoin generates no natural yield but requires no physical storage.

The total market capitalization of above-ground gold approximates $13 trillion, while Bitcoin currently sits around $1.3 trillion. For Bitcoin to match gold's valuation would require nearly 10x price appreciation from current levels. To reach the $1.85 million level needed in our theoretical debt scenario would require Bitcoin's market cap to exceed $36 trillion, nearly three times all gold ever mined.

Alternative Scenarios And More Realistic Cryptocurrency Applications

While the idea of Bitcoin directly eliminating US national debt makes for provocative thought experiments, more realistic scenarios deserve consideration. Rather than an all-or-nothing approach, cryptocurrency could play supporting roles in national fiscal strategy.

The US government could allocate a small percentage of reserves to Bitcoin, similar to how central banks hold modest gold reserves. If Bitcoin continues appreciating over decades as many analysts predict, even a small allocation could generate significant value to offset debt service costs. This measured approach avoids market disruption while providing upside exposure.

Cryptocurrency taxation presents another avenue for fiscal benefit. As adoption grows and cryptocurrency transactions become ubiquitous, tax revenues from capital gains, transaction fees, and business activities could contribute substantially to government coffers. Proper regulatory frameworks that encourage innovation while ensuring compliance could maximize these revenues.

Blockchain technology underlying cryptocurrency offers efficiency gains for government operations. Smart contracts could automate bureaucratic processes, reducing administrative costs. Transparent blockchain recordkeeping could reduce fraud and improve accountability. Digital currency innovations like central bank digital currencies (CBDCs) might lower costs of monetary policy implementation.

Join Binance to explore cutting-edge blockchain innovations and position yourself at the forefront of the digital finance revolution.

Portfolio Diversification Strategies Including Altcoins And DeFi

While Bitcoin dominates discussions about cryptocurrency and national debt, the broader digital asset ecosystem offers numerous opportunities for diversification. Ethereum serves as the foundation for decentralized finance (DeFi), non-fungible tokens (NFTs), and countless blockchain applications. Its smart contract functionality enables programmable money and automated financial services impossible with traditional systems.

Other prominent cryptocurrencies address specific use cases and technical niches. Solana offers high-speed, low-cost transactions for consumer applications. Cardano emphasizes peer-reviewed research and formal verification for security. Polkadot enables interoperability between different blockchains. Each project presents different risk-reward profiles and investment theses.

DeFi represents perhaps the most revolutionary application of blockchain technology, enabling peer-to-peer lending, borrowing, trading, and yield generation without traditional intermediaries. Users can earn substantial returns by providing liquidity to automated market makers or participating in yield farming strategies. However, these opportunities come with smart contract risks, impermanent loss considerations, and complex technical requirements.

Prudent investors diversify across multiple quality projects rather than concentrating entirely in Bitcoin. This approach balances Bitcoin's relative stability and established network effects against potentially higher growth rates from smaller-cap alternatives. Position sizing should reflect each asset's volatility and the investor's risk tolerance and conviction.

Technical Analysis And Market Psychology In Cryptocurrency Trading

Successful cryptocurrency trading requires understanding both technical chart patterns and the psychological factors driving market participants. Bitcoin's price action follows identifiable patterns, with clear bull and bear market cycles spanning roughly four years, often correlating with Bitcoin's halving events that reduce new supply issuance.

Technical analysts identify support and resistance levels where buying and selling pressure creates price boundaries. Moving averages help smooth volatility and identify trends. Relative strength index (RSI) and other momentum indicators signal overbought or oversold conditions. Volume analysis confirms the conviction behind price moves.

Market psychology often matters more than fundamentals in short-term trading. Fear and greed drive explosive moves in both directions. FOMO (fear of missing out) causes retail investors to buy tops, while panic selling creates capitulation bottoms. Professional traders recognize these patterns and position themselves contrarian to emotional crowds.

The cryptocurrency market's 24/7 nature and global participation creates unique dynamics compared to traditional markets. Asian trading sessions often show different character than European or American hours. Weekend trading typically experiences lower volume and higher volatility. Major news events create immediate price reactions regardless of time zone.

Security Best Practices For Cryptocurrency Holders

Protecting cryptocurrency holdings requires vigilance and understanding of various security threats. Unlike traditional bank accounts with FDIC insurance and fraud protection, cryptocurrency transactions are irreversible and responsibility for security falls entirely on the holder.

Hardware wallets offer the highest security for significant holdings, storing private keys on dedicated devices that never connect directly to the internet. Popular options like Ledger and Trezor use multiple security layers to prevent unauthorized access. Even if a computer is compromised by malware, hardware wallets protect funds from theft.

For active trading positions maintained on exchanges, users should enable all available security features. Two-factor authentication using authenticator apps provides stronger protection than SMS codes, which can be intercepted through SIM swapping attacks. Withdrawal address whitelisting ensures funds can only be sent to pre-approved destinations. Email notifications alert users to suspicious account activity.

Secure your crypto future with Binance advanced security infrastructure including SAFU fund protection and industry-leading cold storage practices.

Social engineering represents perhaps the greatest security threat. Scammers impersonate exchange support, promising to help with account issues while actually stealing credentials. Phishing websites mimic legitimate platforms to capture login information. Fake giveaways promise to double any Bitcoin sent to fraudulent addresses. Healthy skepticism and verification of all communications protect against these tactics.

The Global Context Of Cryptocurrency Adoption And National Strategies

While this analysis focuses on US debt and Bitcoin, cryptocurrency adoption is a global phenomenon with nations taking varied approaches. El Salvador's Bitcoin adoption experiment provides real-world data about cryptocurrency as national currency. The Central African Republic briefly adopted Bitcoin before reversing course, demonstrating implementation challenges.

China banned cryptocurrency trading and mining, citing financial stability and energy concerns, yet simultaneously developed its own central bank digital currency. Russia has shown mixed signals, sometimes embracing cryptocurrency as a sanctions-evasion tool while other times restricting its use. India has proposed and withdrawn various bans while struggling to develop coherent policy.

Meanwhile, smaller nations and forward-thinking jurisdictions compete to become cryptocurrency hubs. Malta, Switzerland, Singapore, and the UAE offer friendly regulatory environments and attract blockchain businesses. These countries recognize that cryptocurrency and blockchain technology represent transformative innovations worthy of support rather than suppression.

This global regulatory arbitrage creates opportunities and challenges for cryptocurrency markets. Projects can establish operations in favorable jurisdictions even if their home countries remain hostile. Investors can access cryptocurrency through international platforms regardless of local restrictions. However, this fragmentation complicates efforts to create global standards and could enable illicit activities.

The conversation about Bitcoin potentially addressing America's $36 trillion debt might seem like fantasy today, but it reflects a broader truth about our financial future. Cryptocurrency and blockchain technology are fundamentally reshaping how humanity thinks about money, value, and economic sovereignty. The next generation is growing up in a world where digital assets are as natural as smartphones, where trustless transactions occur instantly across borders, and where financial inclusion reaches populations traditional banking abandoned.

Whether Bitcoin reaches $1.85 million or remains a modest store of value, the cryptocurrency revolution has already succeeded in demonstrating that alternatives to centralized monetary control can work. Millions of people now hold assets that no government can confiscate, no central bank can inflate away, and no border can constrain. This represents a fundamental shift in the balance of economic power, returning financial sovereignty to individuals.

If you've read this far, you understand that something profound is happening in global finance. The question isn't whether cryptocurrency will play a role in your financial future, but rather how large that role will be and whether you'll position yourself to benefit from this transformation. The infrastructure is in place, the adoption is accelerating, and the opportunities are available to anyone with curiosity and courage to participate. The financial world our grandchildren inherit may look nothing like the one we knew, and that's cause for tremendous optimism about increased freedom, opportunity, and prosperity for all.