- BHT

- 0

90

90

0

0

The cryptocurrency landscape witnessed another historic milestone as Binance unveiled its 49th HODLer Airdrops project featuring Morpho (MORPHO), a revolutionary decentralized finance protocol that's redefining how institutional and retail investors approach crypto lending and borrowing. This groundbreaking announcement marks more than just another token listing-it represents the convergence of traditional finance with decentralized infrastructure, offering unprecedented opportunities for BNB holders to participate in one of the fastest-growing DeFi ecosystems.

Join Binance now to claim your MORPHO rewards and start earning passive income

What Makes the MORPHO HODLer Airdrop Extraordinary

Binance allocated an impressive 6, 500, 000 MORPHO tokens-representing 0.65% of the total token supply-to reward users who subscribed their BNB to Simple Earn (Flexible and/or Locked) and/or On-Chain Yields products between September 28, 2025, 00: 00 UTC and September 30, 2025, 23: 59 UTC. The HODLer Airdrops information became available within 24 hours of the announcement, with the new tokens distributed to users' Spot Accounts at least one hour before trading commenced.

What distinguishes this airdrop from conventional token distributions is its retroactive nature-users who consistently held BNB during the snapshot period automatically qualified without any additional action required. This passive reward system eliminates the complexity typically associated with airdrops, requiring no forms, no manual claims, and no promotional tasks.

Beyond the initial airdrop allocation, Binance committed an additional 1, 000, 000 MORPHO tokens for post-listing marketing campaigns, demonstrating long-term commitment to community engagement and project growth. This strategic approach ensures sustained momentum and provides multiple opportunities for community participation beyond the initial distribution.

Secure your spot for future airdrops-register on Binance today

The Morpho Protocol: Institutional-Grade DeFi Infrastructure

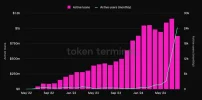

Morpho emerged as the second-largest DeFi lending protocol with a total value locked (TVL) that experienced explosive growth throughout 2025. The protocol's deposits surged by 121% year-over-year, reaching approximately $11.5 billion, establishing it as a dominant force in the decentralized lending sector. This remarkable growth trajectory reflects increasing institutional confidence in DeFi infrastructure and Morpho's innovative approach to capital efficiency.

The protocol operates as a permissionless decentralized lending platform built on the Ethereum Virtual Machine (EVM), enabling overcollateralized lending and borrowing of crypto assets including ERC20 and ERC4626 tokens. Unlike traditional pool-based lending protocols, Morpho introduces a revolutionary peer-to-peer matching mechanism that connects lenders directly with borrowers, dramatically improving capital efficiency while maintaining liquidity through integration with established platforms like Aave and Compound.

What sets Morpho apart is its trustless, immutable smart contract architecture designed to function indefinitely on the Ethereum blockchain. The protocol empowers anyone to create permissionless lending markets with customizable parameters, including different collateral tokens, borrowable assets, and Oracle-agnostic pricing mechanisms. This flexibility attracts both retail users seeking optimized yields and institutional players requiring predictable loan terms with robust risk management controls.

Historic Banking Integration: Société Générale Partnership

In a development that signals the mainstream adoption of DeFi infrastructure, Société Générale-one of Europe's largest banking institutions-selected Morpho as its DeFi lending infrastructure partner in September 2025. Through SG-FORGE, the bank's regulated digital asset division, Société Générale integrated its MiCA-compliant stablecoins EURCV and USDCV with Morpho's lending and borrowing infrastructure.

This partnership represents a pivotal moment for decentralized finance, as it marks one of the first instances where a major European bank moved beyond testing phases to actively utilize DeFi protocols for institutional lending operations. The integration enables Société Générale's institutional clients to mint deposits 1: 1 from fiat into regulated stablecoins, then deploy them on Ethereum into Morpho Markets collateralized by blue-chip assets including BTC, ETH, and tokenized money market fund shares.

Morpho Vaults curated by MEV Capital facilitate institutional-grade lending and borrowing in EURCV and USDCV, with market maker Flowdesk providing day-one liquidity and Uniswap listing the assets to support depth and discoverability. This collaboration demonstrates how regulated, high-quality stablecoins from traditional financial institutions can seamlessly integrate with compliant DeFi infrastructure, unlocking institutional liquidity for on-chain lending markets.

Don't miss out on the future of finance-join Binance and access MORPHO

Crypto.com Strategic Integration Expands Morpho's Reach

Building on institutional momentum, Crypto.com announced its integration with Morpho in October 2025, enabling users to borrow wrapped crypto assets and earn returns on stablecoins through the DeFi lending protocol. The Singapore-based cryptocurrency exchange revealed plans to establish stablecoin lending markets on the Cronos blockchain, with the first vaults anticipated to launch later in 2025.

This integration allows Crypto.com users to deposit wrapped Ether (CDCETH) or wrapped Bitcoin (CDCBTC) into Morpho vaults and utilize them as collateral to borrow stablecoins while earning yield. Merlin Egalite, Morpho's co-founder and integration team lead, emphasized the protocol's goal to provide a trusted user experience on the frontend while maintaining DeFi infrastructure in the backend.

The partnership exemplifies the "DeFi mullet" strategy-abstracting away technical complexities behind consumer-friendly interfaces. With centralized exchanges like Crypto.com handling the user-facing elements while Morpho powers the decentralized lending infrastructure, this approach makes sophisticated DeFi functionality accessible to mainstream users without requiring deep technical knowledge.

MORPHO Token Listing Details and Market Performance

Binance listed MORPHO on October 3, 2025, at 15: 00 UTC, opening trading against multiple pairs including USDT, USDC, BNB, FDUSD, and TRY. The seed tag was applied to MORPHO, indicating it as an innovative project with potentially higher volatility-a designation that signals both opportunity and appropriate risk awareness for traders.

The token's specifications reveal a total supply of 1, 000, 000, 000 MORPHO with a maximum supply cap at the same level, ensuring no additional token minting beyond the initial allocation. Upon listing, the circulating supply reached 338, 801, 056 MORPHO, representing 33.88% of the total token supply. This measured release schedule prevents market oversaturation while providing sufficient liquidity for healthy price discovery.

Binance charged zero listing fees for MORPHO, demonstrating the exchange's commitment to supporting innovative DeFi infrastructure projects. Spot Algo Orders were enabled simultaneously with the listing, while Trading Bots and Spot Copy Trading functionality became available within one hour of spot trading commencement. Additionally, margin trading for MORPHO/USDT and MORPHO/USDC pairs was introduced shortly after listing, providing sophisticated traders with leveraged exposure options.

Start trading MORPHO with zero fees-create your Binance account

Understanding the HODLer Airdrop Mechanics

The Binance HODLer Airdrops program rewards BNB holders retroactively through token distributions based on historical snapshots of their BNB balances. Unlike earning methods requiring ongoing actions, HODLer Airdrops offer a simple, passive approach to earning additional tokens by subscribing BNB to Simple Earn products and/or On-Chain Yields.

Binance implements a sophisticated snapshot system, taking multiple snapshots at any point during each hour to calculate users' hourly average balances in qualifying products. The exchange uses historical snapshots of user balances at random periods after announcements to calculate rewards, adding an element of fairness that prevents gaming the system.

For the MORPHO airdrop specifically, Binance utilized snapshot data potentially collected between September 28-30, 2025, though the exact snapshot timing remained undisclosed until after the event period. This retroactive approach ensures that genuine long-term BNB holders benefit rather than users attempting to manipulate snapshot timing.

Reward distribution follows a proportional model where each user's allocation equals their average BNB holding divided by total average BNB holdings, multiplied by the total reward pool. Importantly, Binance implements a fairness cap of 4% maximum holding ratio-if any user's holding percentage exceeds 4%, their calculation is capped at that level to prevent whale domination of reward distribution.

Maximizing Benefits: Key Advantages for Participants

For BNB HODLers

The MORPHO airdrop delivered exceptional value to BNB holders who maintained positions in qualifying products. The program required zero effort beyond subscribing BNB to Simple Earn or On-Chain Yields, eliminating complex procedures while providing free token rewards. This effortless reward mechanism aligns perfectly with long-term investment strategies, allowing users to accumulate diverse crypto assets passively.

The listing on Binance created immediate liquidity and market access, potentially driving positive price momentum for MORPHO tokens received through the airdrop. Historical data from previous HODLer Airdrops demonstrates that many projects experience significant trading volume and price appreciation following Binance listings, offering participants potential capital appreciation beyond the initial airdrop value.

For the Morpho Ecosystem

The Binance listing provided MorphoLabs with unparalleled exposure to millions of global users across one of the world's largest cryptocurrency exchanges. This visibility accelerates user acquisition, driving deposits into the protocol and expanding the total addressable market for Morpho's lending and borrowing services.

The airdrop mechanism fostered active community participation and helped build a sustainable, engaged user base invested in the protocol's long-term success. With a substantial circulating supply combined with listing on a leading exchange, Morpho established a healthy trading foundation that supports price stability and liquidity depth.

Join the growing Morpho community through Binance-register here

DeFi Lending Sector: Record-Breaking Growth

The broader DeFi lending sector experienced unprecedented expansion throughout 2025, with total value locked reaching an all-time high of $138 billion in September 2025. This represents more than double the TVL from mid-April 2025, establishing decentralized lending as the dominant DeFi use case, surpassing even liquid staking protocols.

Multiple factors drove this explosive growth, including favorable regulatory developments such as the EU's MiCA framework and U. S. Stablecoin legislation that provided legal clarity for institutional participation. The tokenization of real-world assets converted previously illiquid holdings into usable collateral, expanding the scope of assets available for DeFi lending markets.

The stablecoin market's expansion fueled demand for lending protocols, as yield-seeking investors allocated capital to platforms offering competitive returns on stable assets. Additionally, the rise of looping strategies-where users repeatedly borrow and re-deposit assets to amplify yields-contributed to TVL growth across major lending protocols.

Morpho's Competitive Position and Base Network Dominance

Within this expanding DeFi lending landscape, Morpho solidified its position as the second-largest protocol, maintaining substantial market share despite Aave's larger overall TVL. Morpho's strategic focus on institutional-grade infrastructure and customizable lending markets differentiated it from competitors relying primarily on pool-based models.

The protocol's explosive growth on Base-Coinbase 's Layer 2 blockchain-demonstrated Morpho's ability to capture market share on emerging networks. By October 2025, Morpho ranked as the number two business on Base by TVL, second only to Circle, with the protocol's Base deployment approaching $2 billion in total value locked.

This growth was partially driven by Morpho's integration with Coinbase's crypto-backed loans product, which originated over $500 million in USDC loans with collateral surpassing $860 million. The collaboration enabled Coinbase users to borrow stablecoins against BTC holdings, contributing nearly $1 billion to Morpho's TVL on the Layer 2 network.

DeFiLlama data revealed that Morpho and Aave together accounted for over 60% of lending protocol TVL on Base, cementing the network's position as a critical hub for decentralized lending activity. In June 2025, Morpho on Base achieved a significant milestone by flipping Aave on Arbitrum to become the largest lending protocol by TVL on any Ethereum Layer 2 solution.

Innovation and Technical Advantages

Morpho's technical architecture delivers multiple advantages that attract both retail and institutional users. The protocol's flexibility enables tailored loan structures with customizable durations, interest rates, and collateral requirements, providing users with unprecedented control over their lending and borrowing positions.

The introduction of Morpho Vaults simplified passive yield generation, allowing users to earn returns without selecting individual markets or managing complex strategies. These vaults aggregate and amplify withdrawable liquidity, giving lenders superior liquidity profiles compared to traditional multi-asset lending pools.

Morpho implements sophisticated risk controls including position caps, role-based permissions, adapters for external protocol integration, and timelocks that prevent misuse or extreme exposure. These institutional-grade risk management tools make the protocol particularly appealing to professional investors and financial institutions requiring robust safeguards.

The protocol's permissionless market creation system represents a paradigm shift in DeFi lending, democratizing access to customized lending infrastructure previously available only through centralized intermediaries. This innovation positions Morpho as foundational infrastructure for the next generation of financial applications built on blockchain technology.

Experience next-generation DeFi through Binance-sign up now

Eligibility and Participation Requirements

Users must complete account verification (KYC) and reside in an eligible jurisdiction to participate in HODLer Airdrops. Currently, residents of certain countries and regions cannot participate by subscribing to BNB Simple Earn or On-Chain Yields products, including Australia, Canada, Cuba, Crimea Region, Cyprus, Hong Kong, Iran, Japan, New Zealand, Netherlands, North Korea, Russia, United Kingdom, United States of America and its territories, and non-government controlled areas of Ukraine.

This exclusion list reflects evolving local regulations and may be updated periodically to accommodate changes in legal or regulatory factors. Users should verify their eligibility status based on current residence before subscribing BNB to qualifying products.

Important restrictions apply to certain BNB holdings: Assets collateralizing against Binance Loans (Flexible Rate) are not entitled to HODLer Airdrops rewards. However, BNB subscribed to Simple Earn products continues providing standard benefits for holding BNB, including eligibility for Launchpool, Megadrop, and VIP benefits in addition to HODLer Airdrops.

At any snapshot time, at least one supported asset must exceed 0.01 BNB to be included in reward calculations. Additionally, Staked Lista BNB (slisBNB) and slisBNB Non-Transferable Receipt (slisBNBx) in Binance Wallet (Keyless) are supported in HODLer Airdrops reward calculations.

Future Opportunities and Ongoing Rewards

Following the successful MORPHO distribution, Binance launched promotional campaigns offering additional rewards to encourage trading activity and community engagement. These promotions featured prize pools totaling 875, 000 MORPHO in token vouchers, demonstrating continued commitment to rewarding active participants in the ecosystem.

The HODLer Airdrops program continues as an ongoing initiative, with MORPHO representing the 49th project in the series. This established track record signals that future airdrops will provide additional opportunities for BNB holders to accumulate diverse token portfolios passively.

Users seeking to maximize their participation in future airdrops should maintain consistent BNB subscriptions in Simple Earn or On-Chain Yields products. Since Binance uses historical snapshots at random periods, continuous holdings throughout each month increase the probability of capturing snapshots during future airdrop qualification periods.

The integration of Morpho into Binance's broader ecosystem-including Earn products, Buy Crypto services, and Convert & Block Trade features-creates multiple touchpoints for users to interact with the protocol. MORPHO Flexible Products were listed on Binance Simple Earn, becoming available for subscription immediately following the spot listing.

Risk Considerations and Responsible Participation

While the MORPHO HODLer Airdrop presented significant opportunities, participants should understand inherent risks associated with cryptocurrency investments and DeFi protocols. The seed tag applied to MORPHO indicates the token may experience higher volatility compared to more established assets, requiring appropriate risk management and position sizing.

Morpho protocol users face several risk factors including liquidation risk if collateral values decline sharply, requiring careful monitoring of health factors. Smart contract risk exists across all DeFi protocols, with Morpho's sophisticated architecture introducing complex components including adapters, vault interest controllers, and new market mechanisms that could potentially contain undiscovered vulnerabilities.

Adapter misbehavior represents another consideration, as external protocol failures could impact connected vaults. As institutional participation increases, regulatory demands for compliance including KYC, licensing, and oversight may intensify, potentially affecting protocol accessibility or functionality.

Digital asset prices remain subject to high market risk and price volatility. Investment values may decline, and past performance does not reliably predict future results. Participants should only invest in products they understand, carefully considering investment experience, financial situation, objectives, and risk tolerance before making decisions.

Conclusion: Positioning for the DeFi Revolution

The Binance MORPHO HODLer Airdrop represents far more than a token distribution-it signals the maturation of decentralized finance infrastructure and the convergence of traditional banking with blockchain technology. With Société Générale selecting Morpho as its DeFi lending backbone and Crypto.com integrating the protocol across its platforms, institutional validation has arrived for decentralized lending.

For BNB holders who participated in the airdrop, the rewards extend beyond immediate token allocation to include exposure to a protocol positioned at the forefront of DeFi innovation. Morpho's explosive TVL growth, institutional partnerships, and technical advantages establish it as critical infrastructure for the next generation of financial applications.

The retroactive nature of Binance's HODLer Airdrops program rewards consistent, long-term holding behavior rather than speculative snapshot gaming. By maintaining BNB subscriptions in Simple Earn and On-Chain Yields products, users position themselves to capture future airdrops while earning standard staking rewards and maintaining eligibility for Launchpool and Megadrop opportunities.

As DeFi lending TVL approaches record highs and institutional adoption accelerates, protocols like Morpho that prioritize flexibility, security, and compliance will likely capture increasing market share. The MORPHO airdrop provided early access to this ecosystem, offering participants a stake in the infrastructure powering the future of global finance.

Claim your position in the future of finance-join Binance and start earning rewards today

Disclaimer: Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not liable for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment. This material should not be construed as financial advice.